Key Takeaways

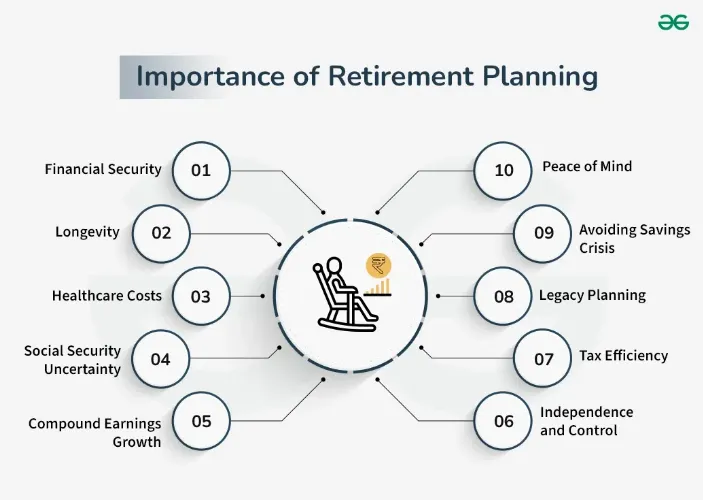

- Retirement planning is crucial to ensure financial stability in your later years.

- Understanding different retirement accounts and their benefits is critical to making informed decisions.

- You may maintain alignment with your objectives by periodically reviewing and modifying your retirement plan.

- Healthy lifestyle choices can complement your financial planning for an enjoyable retirement.

Overview of Retirement Strategy

Retirement planning establishes goals for retirement income and the choices and activities required to reach those goals. It involves developing a strategy to identify sources of income, estimating expenses, implementing a savings program, and managing assets and risk. This process can be exceptionally intricate for those managing small business retirement plans, requiring a detailed approach to safeguarding personal and business interests.

Retirement planning begins long before retirement and is a lifelong process. It’s an ongoing effort requiring contributions from your current earnings toward a future goal—financial independence during retirement. The earlier you begin, the more time you have to grow your assets, making the goal less daunting. Even if you’re closer to retirement age, starting now can make a significant difference by helping you better understand your financial picture and optimize your resources.

Types of Retirement Accounts

Understanding the types of retirement accounts available can help you decide which options are best for you. Common retirement accounts include:

- 401(k):A 401(k) plan is an employer-sponsored retirement savings plan. Part of an employee’s pre-tax pay may be contributed, and companies frequently match a part of employee contributions. It boosts your retirement savings and provides tax advantages, as contributions are often made with pre-tax income.

- IRA:Pre-tax income can be allocated to assets in an Individual Retirement Account (IRA) that can grow tax-deferred until withdrawal. This tax deferral can significantly enhance the growth potential of your investments over time by allowing you to reinvest gains, dividends, and interest without being taxed until you make withdrawals.

- Roth IRA: Unlike regular IRA withdrawals, payouts from a Roth IRA are frequently tax-free since the account is funded using after-tax dollars. It can be a substantial advantage during retirement when you’ll likely be on a fixed income and want to avoid additional taxes.

Setting Realistic Retirement Goals

One of the first steps in retirement planning is setting realistic goals based on your desired lifestyle and expected expenses during retirement. Consider housing, healthcare, travel, and daily living costs. Financial advisors and online calculators can help you estimate how much money you’ll need to save to reach these objectives.

Realistic goal setting is crucial because it provides a clear target. Your goals should reflect not only your basic needs but also your aspirations and lifestyle preferences, from maintaining a certain standard of living to traveling or pursuing hobbies. According to a CNBC personal finance report, early planning and regular saving are crucial for a secure retirement. The report suggests having multiple income streams and keeping a financial cushion to deal with unexpected expenses.

Investing for Retirement

One of the most critical aspects of retirement planning is investing. Keeping a range of stocks, bonds, and other assets in your portfolio may diversify and improve your control over risk and return. When choosing investments, it’s essential to consider your risk tolerance, investment horizon, and financial goals. Increasing your retirement savings may be accomplished by consistently contributing to your retirement accounts and utilizing work matching.

The power of compounding returns cannot be overstated. By starting your investment efforts early, you allow more time for your investments to grow and compound, which can tremendously impact your retirement savings. Diversification is a crucial element that mitigates the effects of market fluctuations on your portfolio by dispersing your assets throughout other asset classes, such as equities, fixed-income securities, and real estate.

Regular Review and Adjustments

Just as important as creating a retirement plan is regularly reviewing and adjusting it. Life changes such as job transitions, market fluctuations, and personal circumstances can impact your retirement goals. Reassessing your strategy periodically ensures that you remain on track and that your plan adapts to changing conditions.

Regular evaluations are a financial checkup that allows you to adjust in response to shifts in your income, costs, and overall market circumstances. For instance, you should increase your savings rate if you receive a promotion or a windfall. Conversely, if you encounter financial difficulties, you should revisit your plan to find areas to cut costs. According to a recent piece from The New York Times business section, staying informed about market trends and economic signals is crucial for making timely and effective adjustments to your retirement plan.

Healthy Lifestyle and Retirement

Financial planning is only part of the equation. Ensuring you maintain a healthy lifestyle can significantly impact your retirement years. By eating a balanced diet, having regular exams, and exercising regularly, you may maintain your health and save on medical expenses. Hobbies and social connections can boost retirement satisfaction and happiness and enhance mental health.

Like investing in money, investing in your health now will pay you later. Physical activities such as walking, swimming, or yoga keep your body fit and reduce stress levels, which is vital for mental health. A well-balanced, nutrient-dense diet strengthens your immune system and promotes general well-being. Routine health checkups can help catch potential issues early, leading to better outcomes and lower healthcare costs. Moreover, participating in social activities and hobbies keeps your mind active and connected, reducing the risk of loneliness and mental decline.

Conclusion

Planning for retirement is a comprehensive process that goes beyond just saving money. It involves setting realistic goals, understanding various retirement accounts, making informed investment decisions, and maintaining a healthy lifestyle to enjoy your later years fully. By being proactive and constantly assessing your plan, you may have a safe and fulfilling retirement.

It is always early enough to start planning. Being proactive, knowledgeable, and constantly modifying your approach as necessary are crucial. With careful preparation, diverse assets, regular evaluations, and an emphasis on health, you can build a solid foundation for a financially secure and satisfying retirement.